|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

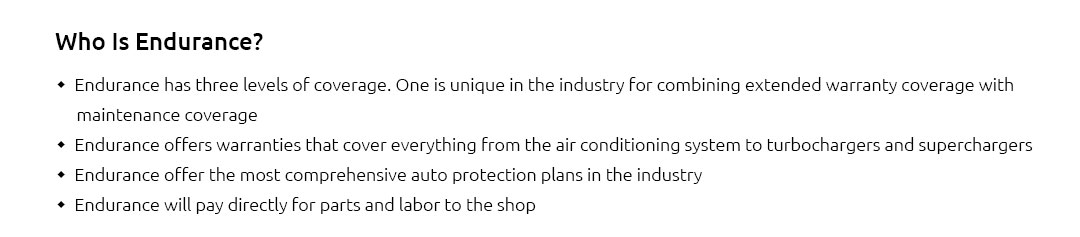

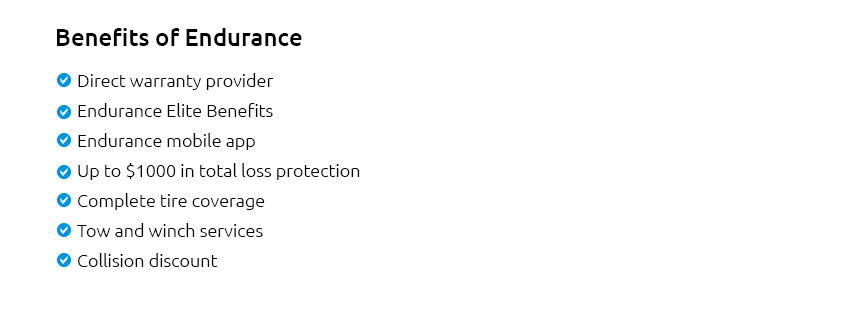

Understanding Mechanical Insurance for Older CarsAs automobiles age, their charm often increases, but so does their propensity for mechanical failures. This is where mechanical insurance steps in, providing a safety net for owners of older vehicles. Often misunderstood or overlooked, mechanical insurance can be a game-changer for those who drive vintage or merely aging cars. But what does it entail, and is it truly beneficial? Mechanical insurance, sometimes known as an extended warranty, covers the cost of repairs and replacements of parts once the original manufacturer's warranty expires. Unlike standard auto insurance, which covers accidents and liability, mechanical insurance focuses on the wear and tear that naturally occurs over time. This distinction is crucial for owners of older cars, who are more likely to face issues such as engine breakdowns or transmission failures, which can be costly without insurance. Many older car enthusiasts, like John from Oregon, find mechanical insurance invaluable. After purchasing a 1998 Ford Mustang, John quickly realized the costs associated with maintaining such a vehicle. 'The insurance has been a lifesaver,' he states. 'When my transmission gave out, I was relieved to have coverage that prevented a financial disaster.' However, not all policies are created equal. It's vital to examine the details, such as which parts are covered and the terms of the coverage. Some policies might exclude certain models or parts, and others may require a deductible. For instance, Susan, a retiree in Florida, discovered that her plan did not cover the air conditioning system in her 2001 Toyota Camry, which led to unexpected expenses. Her experience underscores the importance of understanding the fine print. Additionally, the market offers a variety of providers, each with different reputations and customer service records. Companies like Endurance and CARCHEX are frequently praised for their comprehensive coverage and responsive service. On the other hand, some insurers may have hidden fees or complex claim processes. Thus, researching and reading customer reviews can be as crucial as the policy itself.

Ultimately, the decision to invest in mechanical insurance for an older car depends on individual circumstances. If you're driving an older vehicle that's out of warranty, considering such a policy could be a prudent move. Weigh the costs against the potential savings from covered repairs, and factor in the specific needs of your car and your budget. As cars age, they inevitably require more attention, and mechanical insurance can be the difference between a minor inconvenience and a major financial setback. https://www.endurancewarranty.com/learning-center/mechanical-breakdown-insurance/mbi-for-older-cars-benefits/

MBI is a type of vehicle protection plan that covers repairs for mechanical failures. While this coverage sounds similar to the extended car ... https://optimalwarranty.com/learning-center/auto-repair-insurance-for-older-cars-yes-you-can/

If you're on the road and your vehicle breaks down, call the roadside assistance number provided by your warranty company. Regardless of the time of day or ... https://www.caranddriver.com/car-insurance/a36164153/car-repair-insurance-for-older-cars/

Car repair insurance, or mechanical breakdown insurance, covers the cost of repairing a vehicle's mechanical issues when the warranty period elapses.

|